Business Insurance in and around LAFAYETTE

LAFAYETTE! Look no further for small business insurance.

Almost 100 years of helping small businesses

Your Search For Excellent Small Business Insurance Ends Now.

When experiencing the highs and lows of small business ownership, let State Farm take one thing off your plate and help provide excellent insurance for your business. Your policy can include options such as business continuity plans, extra liability coverage, and a surety or fidelity bond.

LAFAYETTE! Look no further for small business insurance.

Almost 100 years of helping small businesses

Strictly Business With State Farm

When you've put so much personal interest in a small business like yours, whether it's a bakery, a clock shop, or a lawn sprinkler company, having the right protection for you is important. As a business owner, as well, State Farm agent Glenn Jones understands and is happy to offer personalized insurance options to fit your needs.

Call Glenn Jones today, and let's get down to business.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

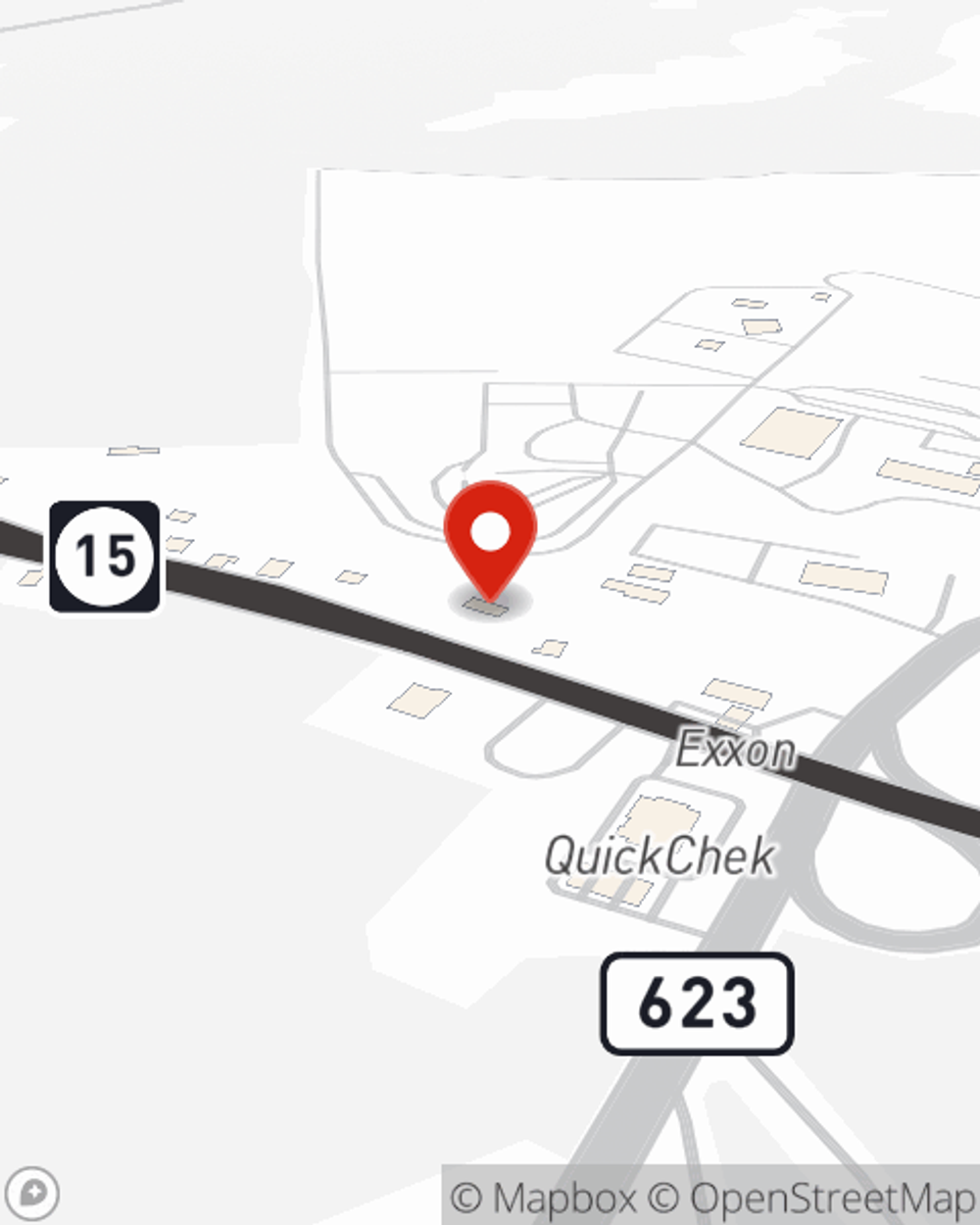

Glenn Jones

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.