Renters Insurance in and around LAFAYETTE

Renters of LAFAYETTE, State Farm can cover you

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

The place you call home is the cornerstone for everything you treasure. It’s where you build a life with the ones you love. Home is truly where your heart is. That’s why, even if you live in a rented townhome or home, you should have renters insurance—especially if you own items that would be difficult to fix or replace. It's coverage for the things you do own, like your sports equipment and tools... even your security blanket. You'll get that with renters insurance from State Farm. Agent Glenn Jones can roll out the welcome mat with the dedication and competence to help you keep your belongings protected. Personalized care and service like this is what sets State Farm apart from the rest. When you're covered by State Farm, your rental can be home sweet home.

Renters of LAFAYETTE, State Farm can cover you

Rent wisely with insurance from State Farm

Safeguard Your Personal Assets

Renters often don’t realize that their landlord’s insurance only covers the structure. Just because you are renting a space or home, you still own plenty of property and personal items—such as a bed, desk, TV, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why secure your belongings with renters insurance from Glenn Jones? You need an agent who wants to help you evaluate your risks and choose the right policy. With efficiency and skill, Glenn Jones is waiting to help you keep your belongings protected.

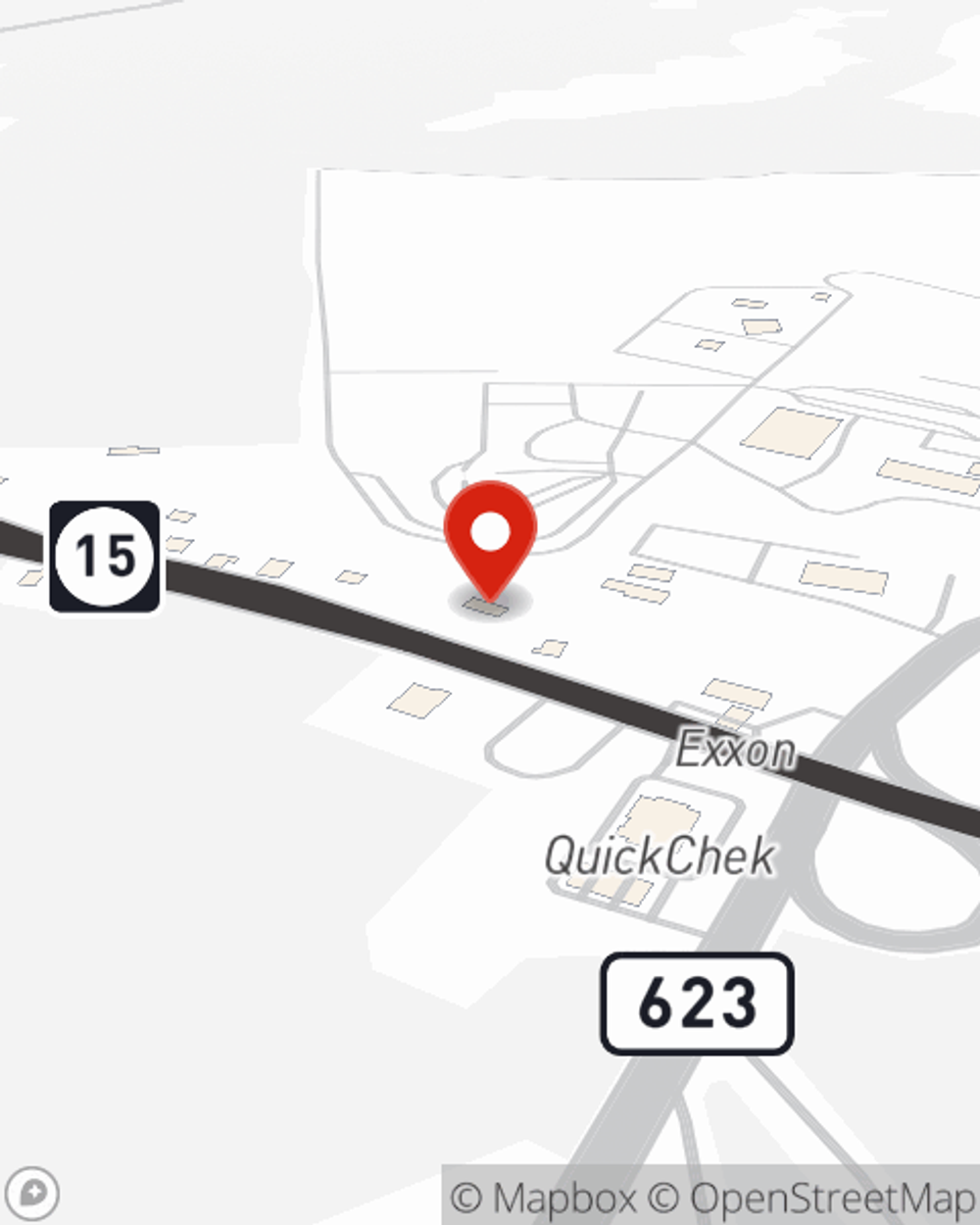

A good next step when renting a house in LAFAYETTE, NJ is to make sure that you're properly insured. That's why you should consider renters coverage options from State Farm! Call or go online today and see how State Farm agent Glenn Jones can help you.

Have More Questions About Renters Insurance?

Call Glenn at (973) 300-0009 or visit our FAQ page.

Simple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.

Glenn Jones

State Farm® Insurance AgentSimple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.